Explore Resources

Articles

Want to know how top gyms are turning retail into a revenue stream? Discover why more fitness centers are rethinking vending—and what they’re offering instead to keep members coming back.

A wave of next-gen, self-service retail is transforming how and where consumers shop — and it’s not just hype. Dive into the real stories of operators breaking sales records, delighting customers, and redefining convenience through the rise of Smart Stores.

Micro markets are booming—and it’s no accident. From tap-to-pay tech to new high-traffic locations, discover what’s fueling their growth and why now’s the time to get in. A quick preview of insights from Cantaloupe’s Micropayment Trends Report.

Choosing the right micro market kiosk can boost ROI and customer satisfaction. Learn how to match kiosk models to real-world environments—from gyms and offices to car dealerships and residential spaces.

The world of self-service retail is on the brink of a major transformation as we head into 2025. Discover the potential for business growth through cutting-edge technologies and the expansion into new markets. This is essential reading for anyone who wants to stay ahead in this dynamic industry.

Smart Stores can transform your vending business by offering more products and a smooth customer experience. Discover how these advanced machines can boost your sales and expand your business into new locations.

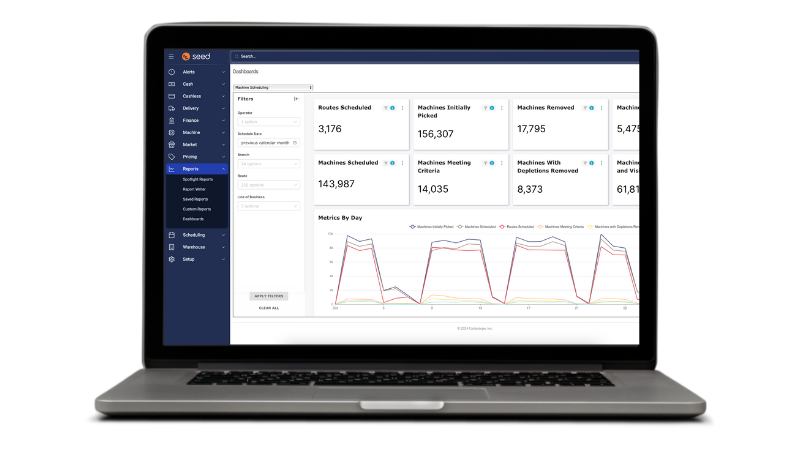

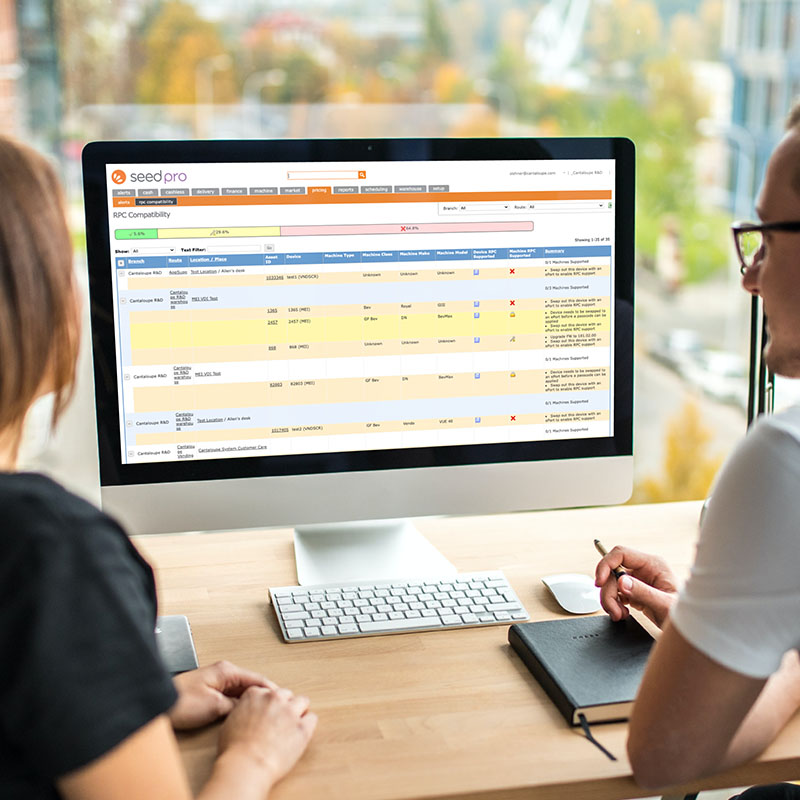

Discover how Seed Analytics can revolutionize your retail operation with seven powerful functionalities that offer real-time insights and actionable data. These tools are designed to boost efficiency, reduce waste, and drive your business forward.

Discover how to launch a vending business with minimal upfront costs. Learn about Cantaloupe Capital’s flexible line of credit and Cantaloupe One’s no upfront cost subscription plans, plus essential budgeting tips and software tools.

Adopting cashless payment systems in the amusement and gaming industry offers several advantages. Cashless transactions, averaging $6.13 per transaction compared to $0.81 for cash, can significantly boost revenue. The initial investment in card readers, which includes hardware, software, training, and marketing, is quickly offset by a short payback period.

The Cantaloupe Smart Store is a revolutionary new way to sell food, beverages, consumer goods, and anything in between. Eliminate shrink with weighted shelf technology and built-in cameras. You’ll maximize sales by accepting any cashless payment method, including mobile wallets.

Using data from vending machines helps businesses. By using solutions like card readers and kiosks, companies can select top products, enhance efficiency, and make smart choices to boost profits and lower costs.

Exact authorization for vending machines uses G10 or G11 card readers to hold the exact purchase amount, reducing confusion and improving customer experience. It requires single-vend mode, allowing only one item per transaction.

To launch and test new micro market products, partner with suppliers, use eye-catching signs, hold customer events, and analyze sales data. These steps help make your market exciting, boost sales, and keep customers happy.

Feel Good Market, led by Aldo Tejada, is transforming shopping in Panama with staffless, cashless micro markets. They aim to expand into homes and hotels, prioritizing customer trust and convenience.

Making businesses accessible helps everyone, including people with disabilities, shop easily. Features like voice prompts and big touchscreens let customers buy things on their own. This makes shopping faster and happier, bringing more people and sales to the store.

To boost micro market sales, understand customer needs, expand to new locations, use reward programs, adjust prices, and highlight high-margin products. Cashless payments, self-service kiosks, and smart coolers make shopping faster, easier, and more fun.

Modernizing business operations helps solve high costs and labor shortages. It involves using technology to improve customer and employee experiences, being flexible, and engaging employees in technological changes for successful transformation.

Micro markets are expanding rapidly, with a 36% increase in locations in 2023. Nearly all payments are cashless, accounting for 96% of transactions. Consumers spend more at micro markets compared to vending machines, and sales are projected to grow by 20% in 2024.

In 2024, self-service retail is shifting towards cashless payments, with vending machines and micro markets expanding. Cashless options increase spending, and card readers enhance profits. Software streamlines micropayments, simplifying shopping and enhancing convenience.

Monumental Markets collaborated with Cantaloupe to enhance services across 500 locations, implementing new software for easier billing and improved scheduling. This upgrade speeds up service and prepares for future technological advancements.

Micro markets are spreading to hotels, luxury apartments, and gyms, offering convenience and a variety of products. This expansion increases accessibility to snacks and essentials, enhancing customer satisfaction and sales.

Seed Markets introduces new tools for better micro market management. Features include one-click market setup uploads, easy inventory tracking, and shortage analysis. These enhancements simplify shrinkage management and support efficient business expansion.

Installing card readers on gaming machines boosts revenue and customer satisfaction by allowing cashless payments, offering business insights, and cutting operational costs. This results in higher spending, smooth transactions, and better operations for operators.

Warehouse picking software improves vending operations by speeding up order picking, reducing errors, and decreasing paper use. It displays pick lists on tablets, allowing workers to manage multiple orders simultaneously.

To secure a micro market, choose safe locations, install security cameras, use live monitors, manage remotely, put up signs, adjust prices, and use kiosks with cameras. These steps help prevent theft and protect your business.

KVM and Blue Agave introduced kegerators, self-serve coffee machines that allow users to pour and pay for the exact amount they drink. Cantaloupe’s Seed Pro software tracks sales, enhancing efficiency and popularity in locations like apartment buildings.

Smart coolers are a cost-effective alternative to vending machines. They use less energy, offer more product choices, and accept cashless payments, making them convenient for customers. These features enhance business efficiency and customer satisfaction.

Cantaloupe’s Remote Price Change tool lets vending machine operators change prices from afar, saving time and money. It helps keep profits steady and customers satisfied with fair prices. It’s a smart way to control vending machine costs.

Technology in vending operations offers real-time sales and inventory insights, simplifies processes such as price adjustments, and boosts customer loyalty with rewards. It supports cashless payments and personalizes experiences, enhancing efficiency and satisfaction in self-service retail.

Implementing cashless payment options in gaming machines boosts revenue by enabling higher spending per transaction, enhancing customer satisfaction, and providing a seamless gaming experience. Real-time sales tracking and integrations also optimize operations.